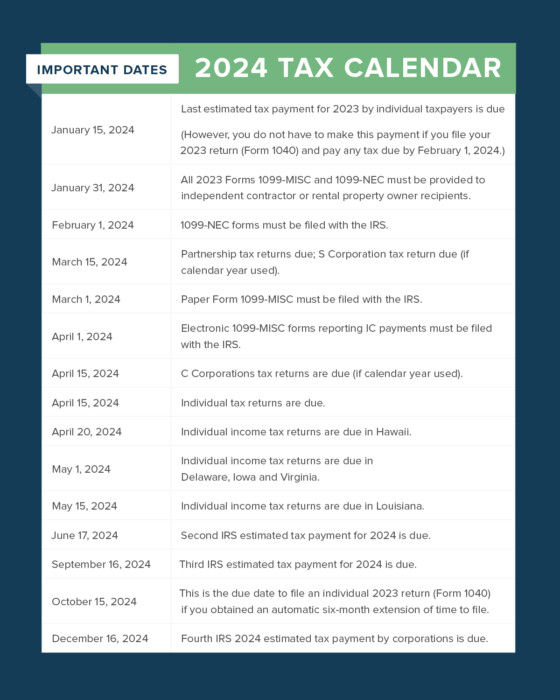

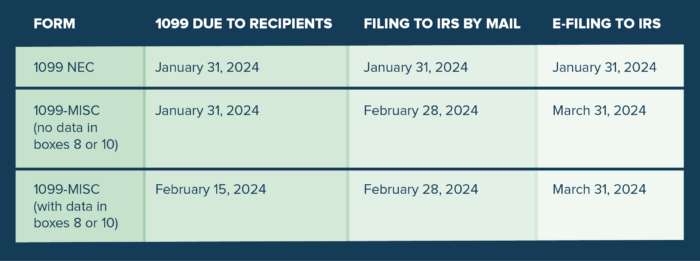

1099-Misc Due Date 2024 Day – It’s tax time. Here’s a look at what you need to know about due dates for your tax forms, including Forms W-2 and 1099, and what to do if you don’t receive yours on time. . Tax season is almost here. Here’s an overview of what to know ahead of filing your 2023 taxes, including deadlines, exemptions, tax credits and more. .

1099-Misc Due Date 2024 Day

Source : blog.checkmark.com1099 For Property Management: Everything To Know | Buildium

Source : www.buildium.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.comWhen & How to file a Form 1099

Source : www.finaloop.comPenalties for Missing the 1099 NEC or 1099 MISC Filing Deadline

In Depth 2024 Guide to 1099 MISC Instructions BoomTax

Source : boomtax.comKyky Tax & Corporate Services | Garden Grove CA

Source : www.facebook.comProperty Management Tax Reporting Made Easy | Buildium

Source : www.buildium.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com2023 1099, W 2 & ACA Filing Deadlines to the IRS and SSA – CUSTSUPP

Source : support.custsupp.com1099-Misc Due Date 2024 Day 1099 Deadlines, Penalties & State Filing Requirements 2023/2024: 2024. Taxpayers need to file a Form 1040 (or Form 1040-SR, for older adults) and pay any tax due by this date. Tax Day is usually on or around April 15. If April 15 falls on a Saturday . Tax season officially begins on Monday, Jan. 29. Here’s everything you need to know to get started, from filing for free to tax deadlines to refunds. .

]]>

.jpg)